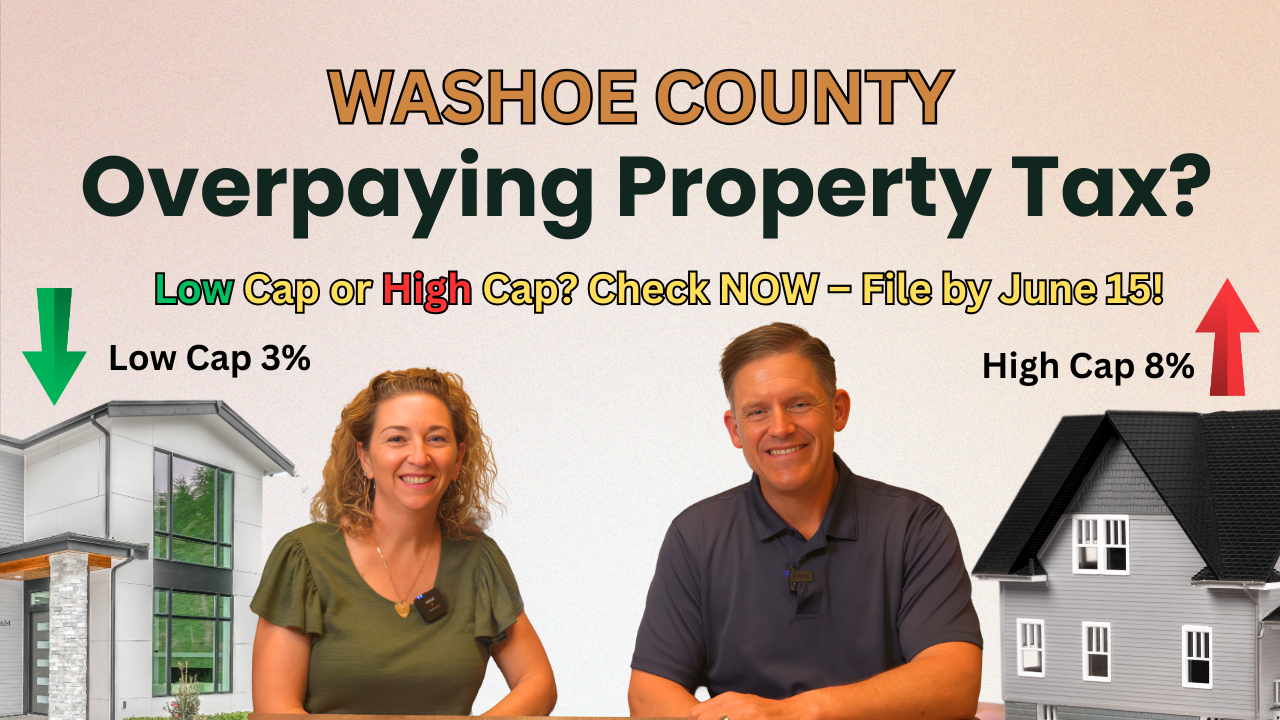

Are You Overpaying on Your Washoe County Property Taxes? File Your Tax Cap Claim Before June 15

If you own a home in Washoe County, Nevada, your property tax bill might be higher than it needs to be — and it all comes down to whether you’ve filed the Property Tax Cap Claim Form.

📺 Washoe County Property Tax Cap 2025/26 | Are You Paying Too Much?

(Don't miss it — the deadline is June 15!)

What Is the Washoe County Property Tax Cap?

Nevada law limits how much your property taxes can increase each year, but the cap depends on how your property is classified:

-

Primary Residence → Tax increases capped at 3% annually

-

Investment/Secondary Property → Capped at 8% annually

That 5% difference can mean thousands of dollars in extra taxes each year. But here’s the catch:

If you don’t file the form, your home is automatically taxed at the higher 8% rate — even if you live in it full-time.

Am I in the 3% or 8% Tax Cap?

A lot of homeowners aren’t sure which cap they’re currently under. Here’s how to find out:

-

Visit the Washoe County Treasurer’s website

-

Search for your property using your address or parcel number

-

Check your current tax cap rate — it’ll show 3% or 8%

🚨 If you see 8% and your home is your primary residence, you need to act fast.

How to File Your 2025–2026 Tax Cap Claim Form

The process is simple, but it’s crucial to do it before June 15, 2025. Here's what to do:

-

File your Tax Cap form online from the Washoe County Assessor's Office Tax Cap/Abatement Information

-

Fill it out — you’ll confirm your home is your primary residence

-

Submit it before the deadline

Once it’s filed and accepted, your property will be taxed at the lower 3% primary residence rate for the upcoming year.

Real Stories: What Happens if You Miss It?

We’ve seen far too many homeowners forget this step — and it’s costly. One Reno couple paid over $1,400 more in property taxes last year because their home was incorrectly classified as a rental. Another Sparks homeowner lost their 3% cap after moving in but never submitting the claim form.

And if you're buying or selling? Not filing could mean a surprise tax bill for the new owner — or a deal falling through due to unexpected costs.

Who Should File This Form?

-

New homeowners in Washoe County

-

Longtime residents who’ve never submitted a claim

-

Buyers and sellers looking to confirm their property’s tax status

-

Landlords converting a property to a personal residence

Don’t Wait — The Deadline Is June 15

After June 15, 2025, your property will be locked into its current classification for the 2025–2026 tax year. Whether you’re looking to save money or avoid a frustrating mistake, filing this form is a no-brainer.

📺 Watch our full video guide here:

👉 Washoe County Property Tax Cap 2025/26 | Are You Paying Too Much?

Need Help or Have Questions?

I’ve helped dozens of homeowners sort this out — I’m happy to help you too.

📲 Call or text: 775-525-0309

📧 Email: ken@livinginsouthreno.com

🌐 Visit: livinginsouthreno.com

Let’s make sure you’re not paying more than you should!

S.168655

#AngstRealEstateTeam #LivingInSouthReno #HautePropertiesNV #RenoRealEstate #SparksRealEstate #PropertyTaxTips

#PropertyTaxCap #TaxCapForm

#RealEstateAdvice