2025–2026 Washoe County Property Tax Bills Are Out — Here’s What to Check

The Washoe County Treasurer’s Office has released property tax bills for the 2025–2026 tax year, and now is the perfect time to take a moment to review yours. Whether you’re a longtime homeowner or recently purchased your property, it’s important to confirm the details of your bill—especially if this is your primary residence. Why? Because Nevada offers a significantly lower tax cap for primary residences compared to second homes or investment properties.

Why Your Property Tax Cap Matters

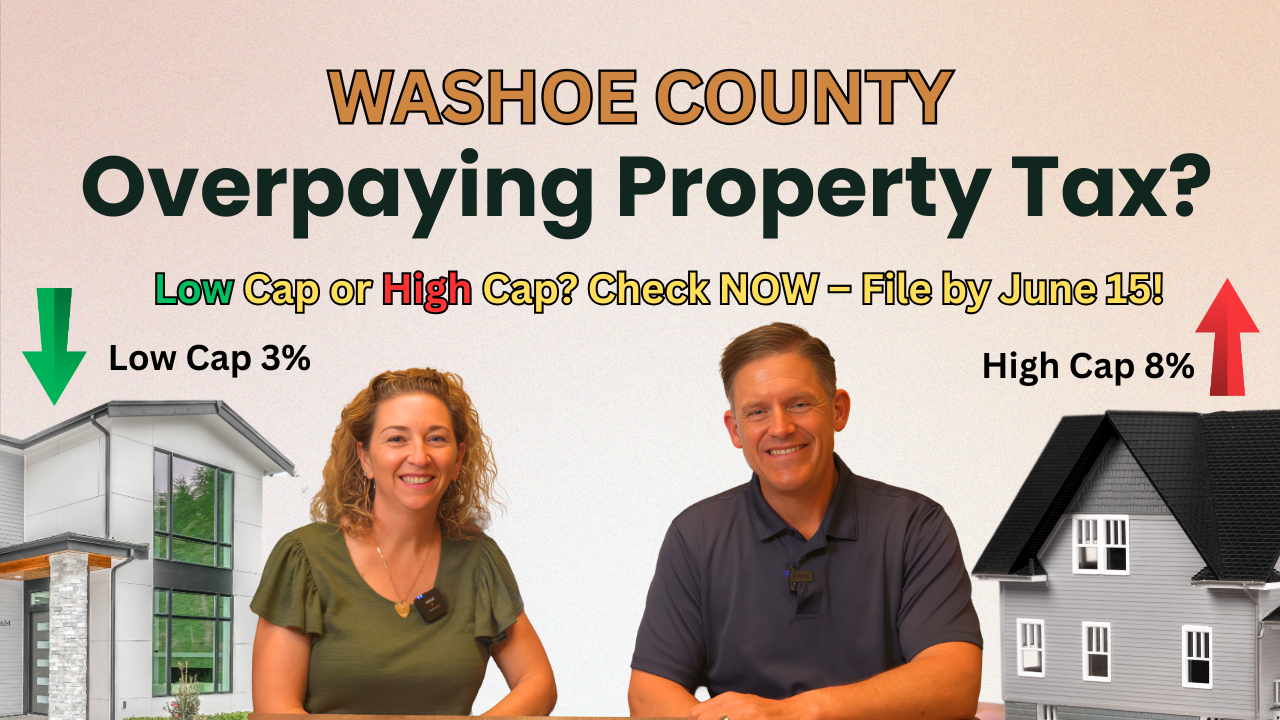

Nevada has a property tax abatement program that limits how much your tax bill can increase each year. For primary residences, the cap is 3%, while non-primary residences (like rentals or second homes) are subject to an 8% cap. That’s a big difference in how much your property taxes can rise over time.

If your home is your primary residence and it's incorrectly coded as non-primary, you could be paying more than necessary.

✅ How to Check Your Property Tax Bill

To view your tax bill, follow these quick steps:

- Visit the Washoe County Treasurer’s Office website: https://nv-washoe.publicaccessnow.com/Treasurer/TaxSearch.aspx

- Search for your property using your parcel number, street address, or your name.

- Click on your property to review your current tax bill, payment history, and balance.

Take note of the total due and whether any increases appear from last year. This is especially relevant if you've recently bought or sold, made improvements, or changed how the property is used.

🏡 Is This Your Primary Residence?

If you live in the home year-round and consider it your primary residence, you’ll want to ensure it’s classified correctly in the county’s system.

Here’s how to verify:

- Visit the Washoe County Assessor’s Tax Cap Lookup Tool: https://www.washoecounty.gov/assessor/cama/

- Search your property using your parcel number, name, or address.

- Look for the Tax Cap Status line.

- If it shows “Low Cap Qualified Primary Residence”, you’re good to go!

- If it says “High Cap”, and this is your primary residence, it’s time to update your records.

📝 How to Fix a Tax Cap Classification

If your property is incorrectly categorized, you’ll need to submit a Primary Residence Declaration Form to the Washoe County Assessor’s Office.

- Download the form here: PETITION FOR REVIEW 2025/2026 PARTIAL ABATEMENT OF TAXES DETERMINATION

Submit it by mail or email as instructed on the form. The sooner you do this, the better—it could save you hundreds of dollars over the course of a few years.

🌍 Not in Washoe County?

If you own property elsewhere in Nevada or out of state and need help navigating your local tax system, I’m happy to assist! Each county has its own system and rules, but the concept of primary residence tax benefits is common. Just reply to this message or reach out directly, and I’ll send over the specific instructions for your area.

💬 A Few Final Thoughts

Property taxes can feel like just another bill, but a quick review can lead to meaningful savings—especially with the tax cap difference between primary and non-primary residences. Taking a few minutes now to double-check your status is a small step that could make a big financial difference down the road.

Have questions or need help checking your parcel number or submitting your declaration form? I’m here to help!

Many thanks to Stephanie Hanna, certified mortgage advisor at Omega Mortgage Group, for her helpful insights. If you are looking for a mortgage lender, contact her at 775-762-9114 or check out her website, http://www.loansbystephanie.com/.

The Angst Real Estate Team

Looking for an experienced Real Estate Team in Reno/Sparks and Northern Nevada? Look no further than Ken Angst and his team! With a demonstrated history of success working with buyers, sellers, and investors, we are the top authority in the area. Stay up-to-date on the latest trends and topics in the Reno/Sparks real estate market with our YouTube Channel featuring our weekly podcast, designed to provide you with the information you need to make informed decisions. Whether you're looking to buy, sell, or invest in property, we have the expertise you need to achieve your goals. Contact us today to learn more! 775-525-0309

S.168655

#AngstRealEstateTeam #LivingInSouthReno #HautePropertiesNV #RenoRealEstate #SparksRealEstate #WashoeCounty #PropertyTaxTips #NevadaHomes #HomeownerTips #PrimaryResidence #RealEstateAdvice #TaxCap #LocalExpert