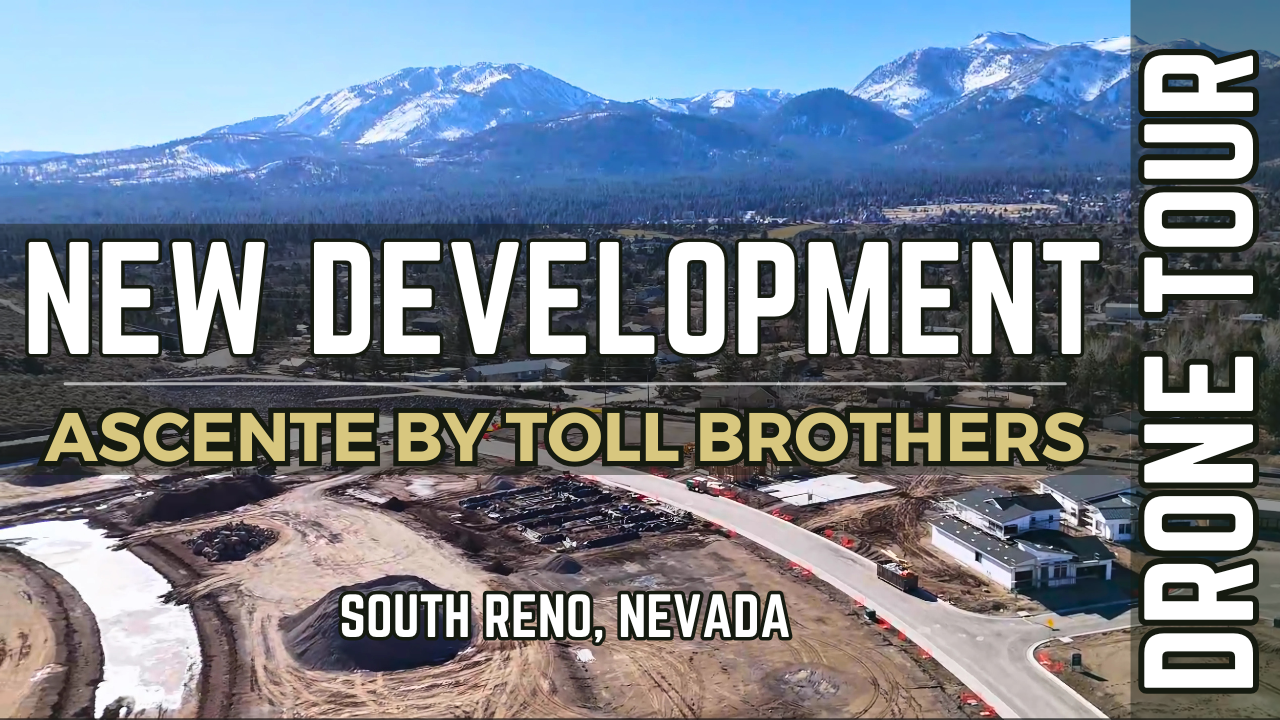

South Reno's Newest Luxury Development: Ascente by Toll Brothers

After many years of development and planning, a new luxury collection of homes by Toll Brothers will soon be available in south Reno. Ascente by Toll Brothers is a new master-planned community featuring two collections of homes: the Copper Rock Collection and the Silver Skye Collection. The homes, which range from 2,611 sq. ft. to over 6,000 sq. ft., will start at $1,100,000.

.png)